2024 Report Summary By Freedonia Industry Report

The luxury vinyl tile (LVT) market, particularly in advanced rigid core segments such as wood-plastic and stone-plastic composites, is expected to experience ongoing growth.

- Exceptional durability

- Noise reduction capabilities

- Stable dimensions

This Freedonia industry report examines the $12.4 billion luxury vinyl tile sector. It includes historical demand statistics from 2012, 2017, and 2022, along with projections for 2027 and 2032, categorized by product type (rigid core and flexible core), market segment (residential and nonresidential), and application (new construction and remodeling). Additionally, annual historical data and forecasts are available for the years 2019 to 2026.

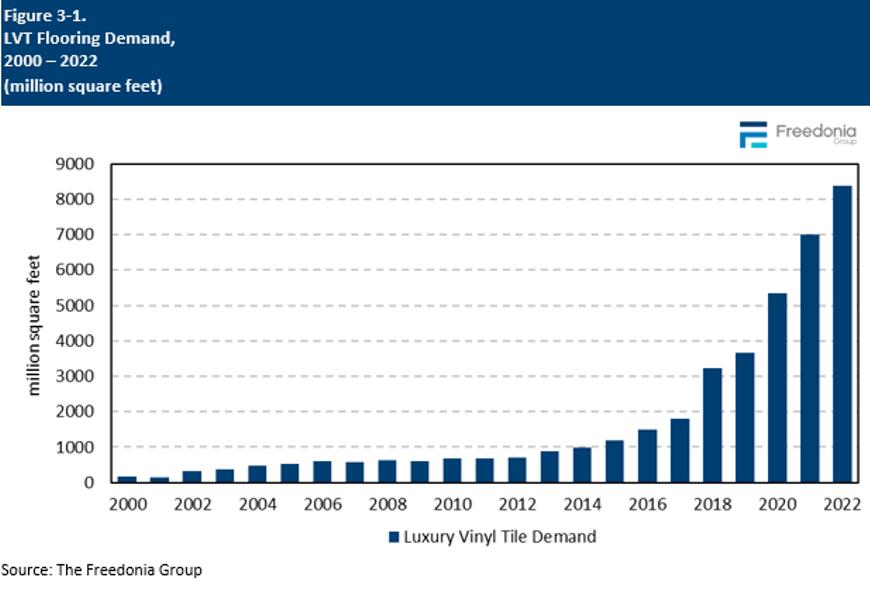

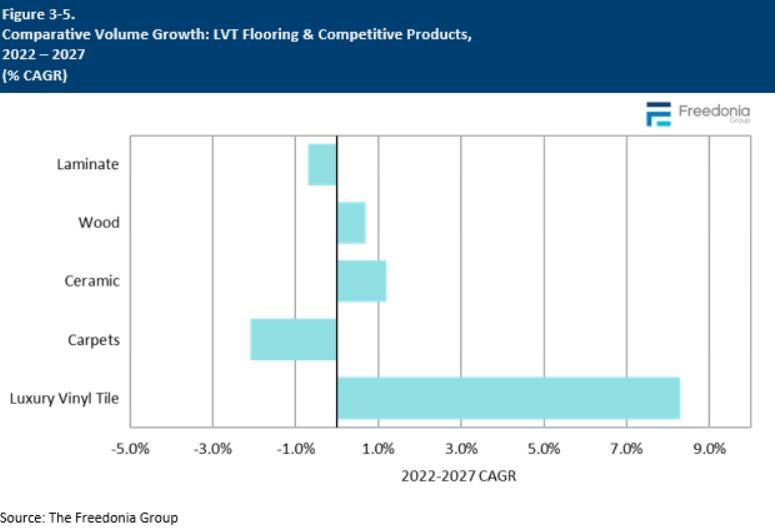

The demand for luxury vinyl tile (LVT) flooring in the United States is anticipated to grow at a rate of 8.3% annually, reaching 12.5 billion square feet by 2027.

This growth is driven by:

- A persistent shift in consumer preferences away from carpet towards LVT and other hard surface flooring options

- An increase in residential remodeling activities in the US through 2027

- The ability of LVT to enhance a home’s market value

- A growing presence in the commercial sector, where flexible core products facilitate the replacement of small areas or individual tiles instead of requiring complete floor replacement

Luxury Vinyl Tile LVT Become the Leading Flooring Choice in the US

By 2024, LVT flooring has for the first time overtake carpeting as the most favored flooring option in the US. Over the past decade, luxury vinyl tile has experienced remarkable market growth, making it one of the fastest-growing flooring products ever launched in the US market. From 2012 to 2022, the volume demand for LVT surged by 28% annually, increasing its market share from 4% to 31%. This demand has been bolstered by its advantageous performance characteristics compared to carpet, including ease of installation, superior visual appeal, and enhanced durability.

Wood Plastic Composite (WPC) Anticipated to be the next Fastest Growing Flooring Type in the US after Stone Polymer Composite (SPC)

As luxury vinyl tile LVT products has gained significant market share in the overall flooring market in the US, more demand for high performance and functional resilient flooring products began to launch as an upgrade to existing resilient flooring categories. The emerging for rigid core resilient flooring, commonly known as Stone Polymer Composition Tiles SPC Flooring, has undertake it self as one of the fastest growing flooring type in the US for the past 5 to 6 years.

It is expected that as the market dynamic shift with more preference for the next generation resilient flooring upgrades, the demand for WPC flooring is projected to expand at a double-digit growth rate during the forecast period according to Freedonia Group market report release. Wood-plastic composite flooring will not only be the quickest growing type of LVT but also the fastest growing flooring product overall in the US.

Despite being the priciest form of LVT flooring, WPC’s usage is expected to rise rapidly due to its product features and performance benefits, which include:

- Enhanced sound absorption and insulation

- Increased resilience and comfort underfoot

- Reduced environmental impact, utilizing fewer non-renewable resources

- Simple installation over various subfloor types, including concrete, plywood, tile, and existing flooring, without requiring extensive preparation or underlayment

Historical Market Trends

The annual demand for flooring is primarily shaped by trends within the construction sector. Nevertheless, the volume of demand is somewhat shielded from economic fluctuations in new construction due to a significant need for replacements in both residential and commercial properties:

- A substantial amount of installed flooring experiences considerable wear and will inevitably need replacement.

- Flooring can sustain irreparable damage before it reaches the end of its intended lifespan (for instance, due to building fires or extreme weather), necessitating new installations.

- Additionally, flooring has an aesthetic function, leading consumers to replace it before its lifespan ends if they wish to update the look of a room or structure.

Fluctuations in currency and pricing can lead to notable volatility in terms of value. For instance, between 2020 and 2022, supply chain disruptions related to the pandemic and soaring raw material costs resulted in price hikes for flooring, causing the demand value to diverge from the area for most flooring types. However, because of its rapid acceptance as a newer material, luxury vinyl tile (LVT) has not been as closely linked to these factors compared to more traditional flooring options.

Product Demand

Luxury vinyl tile consists of a vinyl base, a decorative layer, and a protective finish; it is suitable for various applications in residential and commercial buildings.

The main categories of luxury vinyl tile include:

- Rigid core, which encompasses wood-plastic composite and stone-plastic composite

- Flexible core, which includes LVT with glue-down, loose lay, or click options

Demand for luxury vinyl tile is expected to grow by 8.3% annually, reaching 12.5 billion square feet by 2027. This growth is fueled by manufacturers’ initiatives to provide products with enhanced performance features or more appealing aesthetics.

Wood-plastic composite is projected to increase its market share at the expense of other product types; it is anticipated to experience the fastest growth rate and achieve the largest absolute volume gains, despite being the priciest option, mainly due to:

- Lower susceptibility to denting, cracking, or warping caused by temperature variations or heavy furniture

- Simplified installation, as many products feature interlocking tongue-and-groove systems that can be laid over existing floors

- Homebuilders’ efforts to enhance the attractiveness of their properties to potential buyers by incorporating WPC flooring in areas of the home where it was not typically used (such as living and family rooms).

Homeowners are opting for luxury vinyl tile (LVT) flooring that mimics the appearance of natural wood to enhance both the aesthetic appeal and value of their homes.

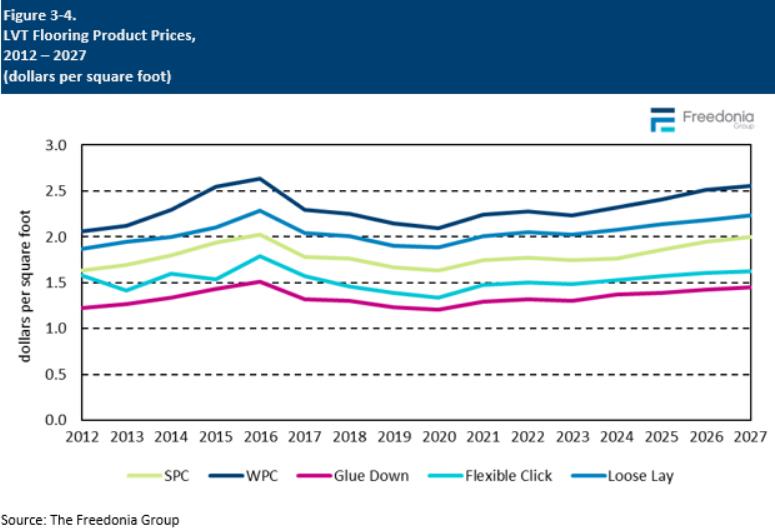

Pricing Trends

The average costs associated with LVT flooring are influenced by several factors, including:

- Costs of raw materials

- Energy expenses

- Geographic demand distribution & Logistics

In 2021, the LVT flooring sector saw significant price hikes, largely due to the economic repercussions of COVID-19-related closures in 2020 at numerous Chinese manufacturing plants, which supply most of the LVT imports to the United States. As demand surged in 2021, these shutdowns impacted flooring manufacturers, leading to a supply-demand imbalance.

It is anticipated that the average price per square foot for LVT flooring in the US will increase by 2.4% annually, reaching $1.89 per square foot by 2027. This growth will be driven by stronger price increases for higher-end rigid core flooring options. Manufacturers are also focusing on producing more visually appealing or high-performance materials, such as flooring with realistic wood grain patterns and textures. Additionally, robust growth in the volume of WPC (the most expensive type of rigid core flooring) will contribute to overall price rises.

Competitive Products

Over the past ten years, wall-to-wall carpeting has been the primary competitor to LVT flooring in residential markets. However, LVT has gained significant market share from carpeting, which has historically dominated the US flooring industry. By the end of 2024, LVT is expected to surpass carpet as the most commonly used flooring option in the country.

LVT also competes with hardwood flooring in several important aspects, presenting advantages that appeal to many consumers:

- Although wood floors can enhance a home’s value, WPC LVT offers a more economical choice in terms of both initial purchase cost and installation.

- Unlike hardwood, which can warp, swell, or become damaged when exposed to moisture, WPC LVT is resilient against spills and humidity, making it ideal for moisture-prone areas like kitchens, bathrooms, and basements.

- While wood floors are durable, they are more susceptible to scratches and dents and may require refinishing over time to maintain their look. In contrast, WPC is built in layers, featuring a wear layer that protects against stains, dents, and scratches.

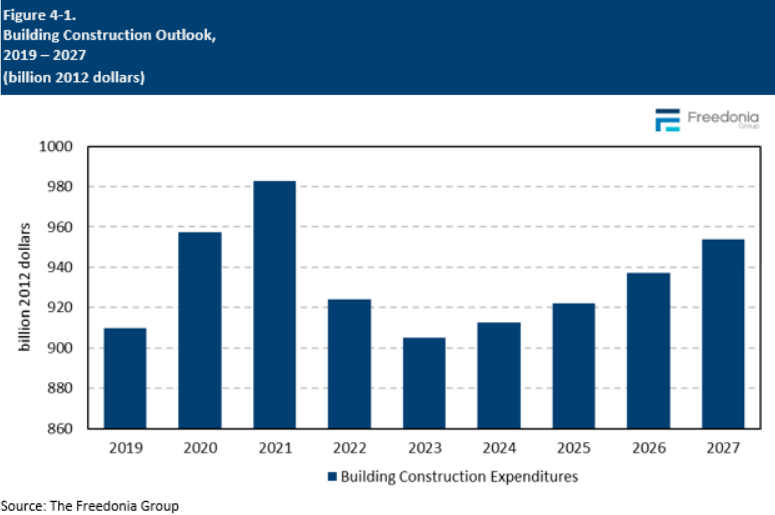

Building Construction Outlook

The demand for luxury vinyl tile flooring is significantly influenced by the health and structure of the US building construction sector.

Real (inflation-adjusted) expenditures for building construction are projected to rise by less than 1.0% per year from 2022 to 2027. Although commercial building construction is expected to recover after the declines caused by the pandemic between 2020 and 2022, much of this recovery will be counterbalanced by a significant decrease in residential building construction in 2023. While residential construction is anticipated to grow again in 2024 and continue to increase throughout the remainder of the forecast period, the levels in 2027 are expected to be lower than those seen in 2021 and 2022.