The rigid core luxury vinyl flooring category is currently undergoing its most significant change since it was invented 11 years ago. In the U.S. flooring market, major shifts in Asian manufacturing partnerships have redirected production from China to neighboring countries such as Vietnam, Cambodia, and South Korea. Additionally, the commoditization of SPC has led to a secondary trend that promotes higher-quality products, while new technologies are enhancing value. Notably, hybrid and PVC-free flooring products are emerging widely, utilizing various materials and chemical compositions.

Rigid Core Luxury Vinyl FLOORING MARKET OVERVIEW

As reported by Market Insights LLC, the U.S. LVT market saw a decline of approximately 10% last year, with preliminary estimates placing its value at $5.8 billion (based on mill sell). Final figures for this category will be available in the May issue of Floor Focus. Imports decreased by 33% in dollar value and 10% in volume. China remains the leading exporter of all types of resilient vinyl flooring to the U.S. market, including rigid core luxury vinyl floorings, covering both residential and commercial sectors with a 58% share, while Vietnam holds the second position with 22%. Other notable exporters include South Korea, Mexico (primarily due to Mohawk’s new facility in Mexicali), Taiwan, Thailand, India, and Cambodia.

Most manufacturers indicate that the builder and multifamily sectors performed well for LVT last year, defying market trends as the category continues to gain ground against hardwood. However, activity in the multifamily sector began to slow down towards the year’s end. The residential remodel segment showed the weakest performance. Commercial business maintained a robust pace, which has carried into 2024, although there are worries about a potential slowdown later this year. Conversely, the residential market is expected to strengthen around the same time, provided no unforeseen events occur.

That said, the only consistent factor in recent years has been the occurrence of unexpected events—such as Covid and its economic repercussions, the war in Ukraine, conflicts in the Middle East, political turmoil domestically, and unpredicted weather occurrences—and who knows what might come next?

According to Tom Van Poyer, CEO of CFL, the current market situation is marked by uncertainty due to various factors. Geo-political issues, including conflicts in the Middle East and changes related to the Panama Canal, have affected the market. Furthermore, the upcoming presidential elections in the U.S. and other countries in 2024, along with persistent inflation challenges, are likely to add to this uncertainty.

It is concerning that both major global shipping canals, the Suez and Panama Canals, are encountering significant challenges. The Suez Canal has experienced a decline in shipping volumes because navigating the Red Sea has become perilous due to Houthi threats. Meanwhile, the Panama Canal is facing a severe drought, which has led to a reduction in crossings by more than one-third.

Most of the imported Luxury Vinyl Tile (LVT) does not rely on these canals. The majority of LVT shipped from Asia arrives at California ports via the Pacific Ocean, except for products heading to East Coast ports like Savannah, Georgia, which must go through the Panama Canal, as well as an increasing amount of goods coming from India that transit through the Suez Canal. However, the real concern lies in container costs, which had stabilized after significant increases during the COVID-19 pandemic but have recently risen again, potentially adding $2,000 to $3,000 in recent months, according to Russ Rogg, president of HMTXs Metroflor.

Yon Hinkle, vice president of product management for resilient at AHF, explains that when a major shipping route is severely disrupted, it affects everyone involved—availability of containers and their costs.

Van Poyer notes that fluctuations in shipping expenses are expected to persist, influencing the overall pricing structure of products. It is crucial to keep track of and adapt to these cost changes.

The Uyghur Forced Labor Protection Act (UFLPA), enacted just over two years ago, continues to disrupt the supply of LVT from Asia to the U.S. market. Customs enforcement at U.S. ports has greatly impacted imports for many American companies, including leading market players, forcing them to seek alternative sources. This situation has resulted in the establishment of new partnerships, primarily in Vietnam, Cambodia, South Korea, Thailand, and more recently, India.

The UFLPA may be influencing the introduction of new PVC-free flooring products in the market. David Sheehan, Mannington’s senior vice president of residential marketing and product, mentions a surge of PVC-free options emerging from Asia in the latter half of last year, stating that Asian suppliers are adapting to the law’s focus on PVC by offering PVC alternative materials.

Van Poyer emphasizes that finding a balance between local and Asian supply sources is becoming increasingly important. This is not just about nationalism; it’s a strategic approach to ensure stability and reduce risks linked to dependence on a single source or region.

Steve Ehrlich, vice president of sales and marketing for Novalis, points out that as container shipping rates rise, production in Mexico and the U.S. becomes more advantageous. The same applies to the effects of UFLPA and other global challenges, as these trade barriers could increase the demand for domestic products.

In terms of domestic rigid core production, which is more automated compared to Asian manufacturing, these products may lack some of the advanced features found in Chinese offerings but excel in quality control, quicker service, and consistent supply. They are generally priced higher than basic imported SPC but lower than premium Asian imports, partly due to increased PVC raw material costs from Texas.

Looking forward, Bill Blackstock, president and CEO of the Resilient Floor Covering Institute, sees promising opportunities in both residential and commercial markets. He expects stability in institutional markets for commercial flex LVT throughout 2024, noting that resilient flooring has been widely used in institutions and will continue to gain market share. Regarding the corporate sector, he believes that the resilience of home offices during the pandemic will bolster the demand for resilient flooring in traditional office spaces. He also highlights hospitality as a rapidly growing segment adopting LVT.

Regarding the residential market, he observes that while 2024 might be slow, there could be a significant surge in renovations in 2025 and 2026. He also points out that another aspect to take into account is homeowners with low-interest mortgages who have available funds. The longer they wait, the greater the likelihood that they will choose to renovate.

Innovations in Vinyl Flooring Products.

Digital Rigid Core Luxury Vinyl Flooring

Historically, China has been known for producing high-quality Rigid Core Luxury Vinyl Tile LVT products. However, in recent years, local rigid core luxury vinyl flooring manufacturers have been enhancing their capabilities by investing in advanced technologies such as Hymmen’s digital direct printing and embossing equipment. Engineered Floors is already utilizing Hymmen technology to manufacture rigid core luxury vinyl tile LVT, with CFL not far behind. HMTX also possesses this technology but is currently applying it to its PVC-free products made in China. The direct printing feature of Hymmen technology eliminates the necessity for a vinyl cap on the rigid core luxury vinyl flooring, which helps to decrease material usage and lower carbon emissions.

New Material Composition for Vinyl Flooring

Another significant trend is the adoption of new materials and construction methods, such as using magnesium oxide instead of vinyl in rigid cores, introducing polyurethanes and other polymers as substitutes for PVC, and even exploring bio-based options. Blackstock notes that there is an increase in various polymers as our extensive product range continues to expand.

Many top U.S. manufacturers now provide alternatives to PVC-based rigid core flooring. However, the market share for PVC-free flooring in the U.S. remains minimal due to challenges related to cost and performance. Currently, there is a higher demand in the commercial sector, although it is important to mention that over the past ten years, more commercial PVC-free products have failed than succeeded.

One company at the forefront is Germany’s Windmöller, which has been offering PVC-free products to both U.S. and European markets for several years, having been active in the U.S. for about a decade. Their offerings include Purline, marketed by Matter Surfaces and Purpose Flooring through Spartan Surfaces, along with various private label initiatives. This product features a bio-based polyurethane that replaces traditional petroleum-based polymers with castor oil. While their business is larger in Europe, they see greater growth potential in the U.S. market.

Tim Cole, director of sustainability and technical services at Windmöller, states that the company has refined its polyurethane flooring over the years to create a high-performance product, which has been shown to outperform standard 20 mil LVT products in tests. Regarding sustainability, Cole mentions, “The only resilient flooring product with a lower carbon footprint than our polyurethane products is linoleum, but it doesn’t offer the same aesthetic variety.”

Hybrid Resilient Flooring

Another notable trend is the emergence of hybrid products, typically a combination of LVT and laminate, which are predominantly free from PVC. These products are thinner than traditional laminate boards and may utilize modified high-density fiberboard, as seen with AHF and Mohawk, or employ unique proprietary formulations.

For example, Classen from Germany recently received a sustainability award at last month’s Domotex expo for its Ceramin flooring, which is PVC-free and made from recycled polypropylene and abundant minerals. Moritz Menier, CEO of Classen Americas, stated that their European laminate facility is the largest globally, with a production capacity of approximately 800 million square feet, while their Ceramin facility can produce 200 million square feet. Classen caters to the U.S. market through its Inhaus brand, which has incorporated Ceramin technology in its Sono line for several years.

Another product trend to monitor is the balance between SPC (Stone Plastic Composite) and WPC (Wood Plastic Composite). Rogg mentions that over the past five years, there has been a swift transition towards SPC, primarily driven by cost, resulting in a decline in WPC. However, interest in WPC is now resurging, and a significant portion of our launch plans this year will focus on WPC.

The prevailing view is that product failures associated with low-end SPC are rekindling interest in WPC, which is a thicker option featuring a foamed core that provides better insulation, warmth, and sound reduction. Sheehan notes that many retailers have had negative experiences with entry-level SPC and are reverting to WPC as a result. Leading companies such as Shaw, Mannington, and HMTX are heavily investing in their WPC product lines.

Significant Brand Developments

Shaw Industries holds a prominent position in the rigid core Luxury Vinyl Flooring market, as it includes Coretec, the first rigid core LVT flooring brand introduced to the U.S. at Surfaces 2013. Since then, the company has significantly broadened its offerings (under both the Coretec and Floorté brands) from the original cork-backed WPC to a variety of WPC and SPC constructions, along with PVC-free magnesium-core products.

At their facility in Ringgold, Georgia, which has been enhanced by a $160 million investment since 2019, the company produces SPC and flexible LVT, while sourcing WPC from Asia.

Josh Martenn, the vice president of hard surface products and TotalWorx, believes that SPC will continue to outpace WPC in growth. He notes that the market for SPC has significantly more volume, capacity, and momentum. Nevertheless, both SPC and WPC offer unique advantages and solutions that cater to customer preferences and requirements.

Martenn predicts a slow market for the first half of this year, primarily due to factors such as housing affordability issues, high interest rates leading to low turnover, and geopolitical uncertainties.

On the commercial front, the company’s robust tile offerings include both rigid and flexible LVT, as well as some bio-based and PVC-free options. In 2022, Shaw Contract and Patcraft launched Rigid Mineral Core, which is constructed without PVC and features a core made from wood fiber, magnesium oxide, and magnesium sulfate. Additionally, last year, these brands introduced bio-based products manufactured in Germany, available in both sheet and tile formats. Martenn explains that these PVC-free products are suitable for high-demand environments, including healthcare, where they can resist most medical stains. He adds that they do not require finishing, waxing, buffing, or stripping for maintenance and can be cleaned with bleach.

Shaw anticipates demand for these products not only in healthcare but also in K-12 education, higher education, and certain corporate settings.

Furthermore, Shaw has partnered with the Classen Group, an innovative German producer of hard surfaces, to distribute its new commercial products in North America and Australia. The PVC-free flooring products utilize Classens Ceramin technology, which combines polypropylene and ceramic powders, and was introduced to the U.S. residential market seven years ago under the Sono brand of Inhaus.

Another key player in the market is Mannington, which produces WPC and glue down flexible LVT in its domestic facilities while sourcing SPC. Its Adura Selling System provides a variety of styles across the three constructions at different price points, helping to maintain the relevance of flexible LVT in the residential sector. Many domestic companies have transitioned their residential flexible LVT offerings to rigid options over the past decade, leaving Mannington with the largest share of the residential flexible market.

Like many manufacturers, Mannington has faced significant challenges with the implementation of UFLPA at U.S. ports, which resulted in a lack of access to 60% of its Adura product line at one point. To navigate this issue, the company relied heavily on its domestic offerings, particularly seeing strong double-digit growth in its WPC products despite a contraction in the market last year.

David Sheehan noted that a major development for Mannington over the past year has been the overhaul of its supply chain. After assessing the extensive implications of UFLPA and recognizing numerous obstacles—some of which seemed unreasonable—the company diligently diversified its supply chain by reconnecting with alternative and new suppliers. “We’ve revamped our supply chain so that those products will be back in stock,” Sheehan stated. “We’re pleased to have our complete portfolio available again.”

Mannington now collaborates with Sayari, a provider of counterparty and supply chain risk intelligence, to ensure clean supply chains. This system is also utilized by U.S. Customs. Additionally, real-time monitoring provides Mannington with immediate alerts regarding any potential issues. The company has also transferred some financial responsibilities to its suppliers as an added layer of security, and Sheehan mentioned that its manufacturing partners were willing to accept these terms to maintain their business relationships.

At last month’s Surfaces show, Mannington introduced NatureForm Glaze, a new surface technology for Adura LVT tile and stone appearances, which offers various gloss levels for a highly realistic finish. This technology was launched with two designs in Adura Max WPC and Adura Rigid SPC. New stair treads that coordinate with all of its wood visuals were also unveiled this year.

Digital direct printing and embossing have emerged as some of the most discussed innovations in the LVT sector recently. Hymmen, a German company, is a leading supplier of the production lines that create this technology. Engineered Floors has become the first company to manufacture SPC domestically using Hymmen’s technology. Their SPC facility, located adjacent to the company’s headquarters, began running samples in November of last year and is currently accepting orders.

All the EFs LVT produced by Engineered Floors in Dalton, Georgia incorporates Hymmen surface technology. Currently, they are manufacturing a 5mm PureGrain DLVT (which includes a 4mm layer plus a 1mm backing), a high-end product featuring a 35-board repeat, although it can accommodate various thicknesses. The four designs showcased at last month’s Surfaces event all exhibit wood aesthetics.

Engineered Floors will continue to obtain SPC from Asia, especially for its lower-tier products, and has ample capacity to expand production at the Dalton plant if necessary. The company currently sources materials from South Korea, Vietnam, and China, having navigated through UFLPA challenges.

According to COO James Lesslie, indications suggest that the single-family builder market will dominate the residential sector this year. While the multifamily segment is expected to experience slower new construction, the relay business (apartment turnovers) may perform well in the latter half of the year. Residential remodeling is likely to be sluggish for at least the first six months of this year.

On the commercial front, the company provides flex LVT, including some 5mm products that can be installed as looselay. The commercial sector performed strongly last year and appears promising so far, although some signs indicate a potential slowdown later this year.

Another company utilizing Hymmen technology is CFL, which is in the process of installing the equipment at its facility in Calhoun, Georgia. Late last year, the firm, recognized as the world’s largest SPC manufacturer, announced plans for an additional $151 million investment in its Calhoun campus, which spans 700,000 square feet, and is also enhancing its production capabilities at its Vietnam site.

At the Domotex expo in Germany last month, CFL was awarded the Green Collection award for its Tenacity product, first launched in 2019. This PVC-free Eco-Composite Flooring, designed for commercial use, contains no polymers and instead utilizes minerals, wood materials, and a cork backing. The company also offers dryback LVT for the commercial sector.

CFL primarily targets the residential market, providing a variety of SPC products, which will soon feature direct digital printing and embossing through Hymmen. Most of the company’s SPC is sourced from its manufacturing facilities in China and Vietnam. Besides SPC, the company also offers dryback LVT and Tenacity, as well as WPC products and acoustic flooring like Novocore Q. Additionally, they have Be-Lite, a thermoformed SPC that utilizes 20% less raw material.

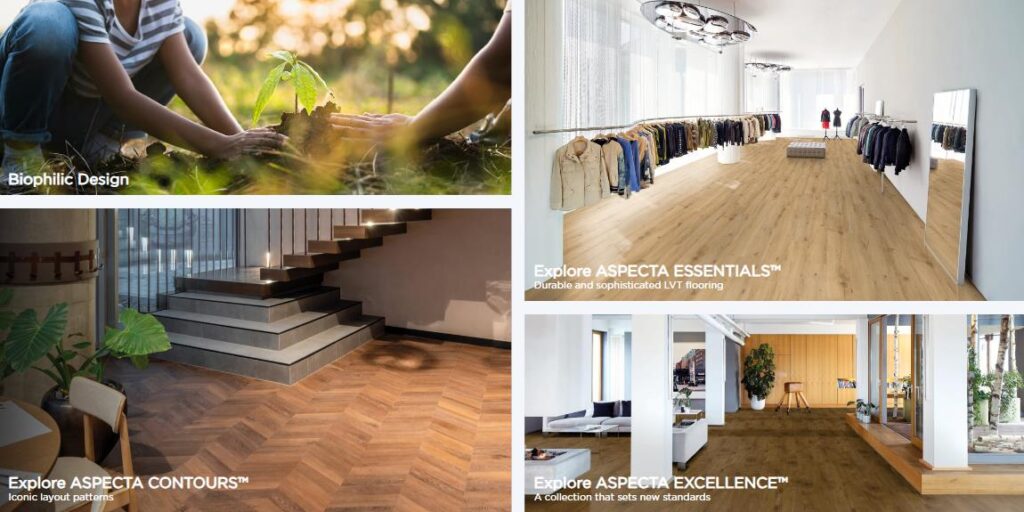

HMTX is another company that has adopted Hymmen technology. Based in Norwalk, Connecticut, HMTX serves both residential and commercial markets through several brands, including Metroflor, Halstead, and HMTX Commercial (Teknoflor and Aspecta), offering a wide range of resilient products. In the commercial sector, most of their resilient tiles are flex LVT, while in the residential sector, they provide WPC, SPC, and glue down flex LVT. The Hymmen equipment has been set up at one of their major long-term manufacturing partners’ facilities, where they have begun producing a PVC-free product known as TPU (thermoplastic polyurethane). This product contains recycled PET and is fully recyclable as a single polymer construction, except for the backing, which is currently made from IXPE (polyethylene).

At this time, Hymmen’s digital direct printing and embossing will be applied only to TPU commercial flooring, with premium-priced products expected to launch soon. HMTX’s Rogg indicated that Metroflor is likely to follow with a residential line. HMTX is also exploring equipment for TPU recovery and recycling, aiming to establish a recycling center in Calhoun, Georgia, to pelletize recovered materials for reuse.

Rogg noted that WPC, marketed under the Halstead (home center) and Metroflor brands, has been performing better after years of losing market share to SPC, partly due to challenges with commodity-level SPC. As a result, the company has expanded its WPC offerings this year, introducing more SKUs than in SPC, including embossed-in-register products.

The company also manufactures WPC domestically at its Pittston, Pennsylvania facility, supplying Home Depot. Most of Metroflor’s SPC is sourced from Cambodia, and this year they will also introduce some SPC and WPC from Vietnam. Flex LVT is produced in South Korea and China.

In recent years, Mohawk Industries, the world’s largest manufacturer of floor coverings, has made significant investments in rigid core luxury vinyl tile (LVT) production capacity in North America. This began with their Dalton facility, which has been operational for approximately four years, followed by the opening of a plant in Mexicali, Mexico, a couple of years ago.

All of their rigid products are stone plastic composite (SPC), with the majority of their offerings falling within the 4mm to 6mm thickness range, although they also provide entry-level options as thin as 3.5mm. Currently, the company is exploring new lighter and less dense SPC materials that still deliver on performance, according to Adam Ward, the vice president of resilient flooring at the company.

Last year, the company introduced a hybrid hard surface flooring product that serves as a PVC-free alternative to both SPC and wood plastic composite (WPC). Produced at their laminate facility in Thomasville, North Carolina, PureTech consists of 70% recycled content, with 80% of its core made from a high-density renewable plant-based material. The company claims this product comes with a lifetime warranty for surface and subfloor waterproofing (WetProtect) and offers three times the scratch resistance compared to standard rigid core LVT products, providing surface protection similar to melamine-topped laminate flooring.

Another significant development in Mohawk’s residential resilient product line is the launch of Signature technology, which was first introduced in their RevWood Premier laminate series two years ago. This technology features high-definition embossing and color roller techniques, utilizing 64 layers of surface data derived from wood samples and up to 1,000 colors to achieve an in-register surface design. Signature technology is set to debut on SolidTech Premier SPC in March.

On the commercial front, Mohawk Group provides both flexible and rigid core luxury vinyl LVT options. The majority of their business is in flexible products, including glue down and loose lay varieties. Traditional glue down LVT remains the preferred choice due to its durability, especially in situations where there are concerns about compression or heavy rolling loads. However, there is increasing demand for thicker loose lay products, which, despite their name, are typically installed using full-spread adhesive or at least perimeter-glued, particularly for seamless installations alongside carpet tiles. Most of Mohawk’s loose lay LVT is sourced from South Korea, with a smaller portion coming from China.

Mohawk Group also provides premium rigid luxury vinyl tile (LVT) that mimics wood and stone. The company reports that its glueless product is gaining popularity across various applications, particularly in areas where sound reduction is essential.

A new player in the rigid core luxury vinyl flooring sector is International Flooring Company (IFC), led by a team with deep roots in the industry. Julian Dossche, the president and CEO, previously worked at Huali; his brother William oversees operations, while their father, Piet Dossche, who is credited with founding the rigid flooring category, serves as chairman of the board.

Based in Dalton, Georgia, IFC launched in November 2022 and targets the residential remodeling market with its mid to high-end Canopy brand of rigid LVT. The company sells directly to a select group of retailers in strategic locations that align with the brand’s target audience, providing its retail partners with a degree of exclusivity. Julian Dossche aims to establish around 2,000 retail partnerships within three years and is actively recruiting Canopy dealers.

Currently, some products are sourced from Asian manufacturers, while others are produced domestically through Huali, including the Canyon Americas line. Canyon, which is IFC’s more budget-friendly SPC product line available through specialty retail, is priced above the commodity level. Its least expensive offerings come from Asian SPC, followed by domestic SPC. Canopy consists of thicker, higher-quality SPC and WPC options. IFC also produces private label items, such as the NFAs Lasting Luxury series. While the Canyon brand is already available on the market, Canopy is set for an official launch in April.

For technological advancements, IFC has teamed up with Broadlume to develop a digital ecosystem for retailers under the Canopy brand, according to Dossche.

Although IFC is currently concentrating on rigid LVT, it plans to expand into the broader hard surface category and expects to introduce new flooring types soon.

Novalis, a prominent global manufacturer of luxury vinyl tile (LVT), provides flexible LVT, stone plastic composite (SPC), and wood plastic composite (WPC) products to the U.S. market. Most of its production is based in China, where the company is headquartered, but it also produces SPC at its Dalton, Georgia facility and became a part-owner of an SPC manufacturing plant in Mexico last year. Novalis is one of the few companies that meets all its LVT requirements through its own manufacturing.

Currently, the output from Dalton represents only a small fraction of the overall flooring revenue; however, as Ehrlich notes, the company can quickly adapt. Furthermore, Novalis plans to expand its capacity in Dalton.

Towards the end of last year, the company introduced a new technology called FlinTile through its licensing partner, Unilin. This innovation allows Novalis to create ceramic appearances on glueless SPC, featuring a groove designed for grouting with a specialized epoxy grout made for LVT. The DIY-friendly design permits foot traffic within 24 hours. At last month’s Surface event, Novalis launched products utilizing this new construction as part of the Novalis Innovation collection, which is accessible across all its distribution channels—residential retail, commercial, and home centers.

Interface primarily targets the commercial sector with its carpet tiles, rubber flooring, and flexible LVT offerings. The company incorporated LVT into its lineup in 2017 by partnering with a South Korean supplier. Its LVT products contain 39% recycled materials, and since 2017, Interface has reduced its carbon footprint by approximately 25%, achieving third-party certification as carbon neutral through the Carbon Neutral Floors program.

“We have experienced significant success with our current sourcing strategy for LVT – our customers endorse this model and are satisfied with our LVT offerings. At this time, we have no intention of altering our approach,” states Sajal Patel, Interface’s senior global director of product and innovation. He adds that the company had a record year for LVT in 2022, and although results for 2023 are not yet available, LVT saw double-digit growth in the third quarter of the previous year.

Regarding alternatives to PVC-free resilient tiles, Interface currently does not provide a replacement for LVT but recommends its rubber flooring line to customers interested in PVC-free options. Patel highlights that this line is particularly suitable for sectors such as healthcare, government, and education, where there is a demand for PVC-free materials.

AHF Products began its journey in the flooring industry by acquiring Armstrong’s hardwood division in 2018 and significantly expanded into the resilient market with the acquisition of Armstrong’s resilient assets two years later. Last year, they added Crossville to their portfolio, which includes ceramic alongside a variety of hardwood constructions, sheet vinyl, self-stick vinyl tile (available through home centers), VCT, flex LVT, SPC, ceramic tile, and laminate. They are set to introduce a WPC line later this year.

The company operates around 15 brands within both residential and commercial markets, with most of its SPC products being marketed under the residential Bruce and Armstrong brands, while Hartco accounts for a smaller share. AHF manufactures a wide range of resilient products, including VCT, LVT, and sheet goods, but sources its SPC mainly from domestic suppliers and some from Asia, particularly Cambodia. According to Hinkle from AHF, their domestically produced products are high-performance with a dense core that requires no acclimation.

In terms of PVC-free offerings for the residential sector, AHF recently launched Ingenious Plank, a hybrid resilient product designed for improved resistance to indentations and scratches. This waterproof product, manufactured in China, features a wood-based encapsulated resin core and melamine. Hinkle notes that unlike many other PVC-free products that come with a higher price tag, Ingenious Plank aligns more closely with standard rigid LVT pricing.

MSI Surfaces, a leading supplier of ceramic tile and stone products, entered the rigid core luxury vinyl flooring market in 2018 with sourced lines of both rigid and flexible LVT products. Just over two years ago, they acquired an SPC facility in Cartersville, Georgia, from RokPlank, which has since been expanded. The company is now enhancing its product lineup with Hybrid Rigid Core (HRC), a PVC-free option.

The construction utilizes our exclusive formulations featuring 100% waterproof technology called DryLuxe from MSI. It is available in the popular 7×48 plank sizes and includes an extra-thick pre-attached comfort and acoustic pad, according to Sam Kim, MSI’s senior vice president of national product. He also noted that the CrystaLux Ultra surface provides 50% greater scratch resistance compared to standard LVT products.

Tarkett has been a significant player in resilient flooring for many years, catering to both residential and commercial markets. In the commercial arena, it is particularly recognized for its Johnsonite brand, which encompasses vinyl and rubber products, as well as its Centiva LVT, now rebranded as Tandus Centiva, and subsequently simplified to Tarkett alongside Johnsonite. On the residential front, Tarkett has been manufacturing sheet goods and flexible LVT for an extended period and was instrumental in transitioning from felt-backed to glass-backed sheet goods in North America during the early 2000s.

Tarkett’s residential lineup features glue down flexible LVT in both 12 mil and 20 mil thicknesses, with the 20 mil variant holding a strong position in the mainstreet market, as well as 5mm SPC (which consists of a 4mm product with a 1mm backing). The SPC primarily showcases wood designs but also includes some stone and tile appearances. Last month, the company expanded its flex products by adding stone and tile visuals and introduced its first WPC, EverGen, an 8mm product (6.5mm plus 1.5mm IXPE backing) with a pressed bevel.

In the commercial segment, Tarkett plans to launch a PVC-free plank and tile collection later this quarter. The Collective Pursuit line will feature a 2.5mm glue down product available in ten wood and stone designs.

Importing Rigid Core Luxury Vinyl Flooring from China

Many global brands import resilient vinyl flooring directly from China and Asia and has gained distinctive market advantages with reduced inventory overheads and quality. Global sourcing remain one of the most important product strategies for flooring brands and flooring distributors.